It’s not uncommon for some full-time agents to drive upwards of 33,000 miles per year for business. That’s a lot of driving! So much driving, in fact, that the average real estate agent drives more business miles in a single year than most of us drive in two years! Hopefully, all this driving is generating a lot of commissions. It also saves many thousands in taxes every year.

The auto deduction is a real estate agent’s largest tax deduction. The federal and state tax savings from properly deducting 30,300 miles is over $6,000 for the average real estate agent! It’s also a deduction that is maximized and simplified by having a qualified home office. Helping real estate agents maximize this important deduction is why we created our course, Auto and Home Office Deduction for Real Estate Agents. In this article, I’ll discuss the relationship between the auto deduction and the qualified home office. Deductible auto use is also the topic of our Two-Minute Tax Take, Real Estate Agent: What Auto Use Can Be Deducted? To learn more about the qualified home office, check out our article, Real Estate Agents - the #1 Key to Maximizing Your Tax Deductions is the Home Office.

Why the Home Office Matters: Every $1,000 in legitimate tax deductions saves the average real estate agent $300 to $400 in taxes. But, the deduction provided by having a qualified home office is usually small compared to the boost it provides another deduction on Schedule C: Line 9 Car and Truck Expenses. Having a qualified home office makes more auto use deductible. It also simplifies the calculation. To illustrate how the home office interacts with the auto deduction, let’s take a quick look at deductible auto use for those who have and those who do not have a qualified home office.

Auto Use without Home Office: For business owners who lack a qualified home office determining deductible business trips can be a challenge. Trips between home and your primary workplace (broker’s office for most real estate agents) are considered commuting. Commuting trips are not deductible. Trips from your primary workplace to a second job, however, are deductible but driving home from your second job is commuting and not deductible. Trips to and from your primary workplace and temporary work locations are deductible as are trips between your home and temporary work locations. Confused? This IRS illustration used in our auto deduction course may help clarify deductible trips for a real estate agent who no qualified home office.

As you can see in the illustration, temporary work locations are very important when it comes to deducting auto use. But what’s a temporary work location? Here’s a brief overview.

Temporary Work Location: The concept of a temporary work location, particularly involving trips from home is complex. As a result, potentially deductible trips are often overlooked by many real estate agents while other real estate agents deduct numerous trips that do not qualify. This complexity makes the auto deduction a common IRS target. The most common reasons auditors deny the deduction is the real estate agent’s failure to prove that destinations qualify as temporary workplaces. The concept is too tangled to unwind in a single article and is why we cover it so extensively in our course, Auto & Home Office Deductions for Real Estate Agents.

Many real estate agents believe the definition of a temporary work location is so encompassing nearly any trip can be transformed into a deduction. Unfortunately, this is belief is based on misinformation and simply not true. A destination must meet several requirements before it qualifies as a temporary work location. Here’s a quick rundown:

- Work Lasts Less than One Year: You must expect to work at the location for less than one year AND must work at that location for less than one year. For most real estate agents, this is an easy hurdle to clear. Showings, business errands, and other common appointments last far less than a year! But, what if you are the exclusive salesperson for a development thirty miles away from your home or broker’s office and are expected to be on site on a regular basis? If you expect the gig to last less than a year and it, in fact, does last less than a year, your miles are deductible. If your expectation or actual duration of the assignment/project runs greater than a year, your trips to and from the development are nondeductible commuting expenses.

- Regular Place of Business: To qualify as a temporary work location you must have one or more regular places of business. If you do not have a qualifying home office, where is your regular place of business? For many real estate agents this would be your broker’s office, assuming you regularly visit and use the office to conduct business. But what if you don’t? What if you only stop by on occasion to pick up or drop off paperwork? Does visiting your broker’s office once per week make this your regular place of business? What about once per month? Determining your regular place of business can be a difficult question to answer, but is necessary to justify your auto deduction. The point - simply working for a broker does not automatically make their office your regular place of business. If you do not use their office to conduct substantial business activities regularly, you may have no regular place of business.

No Regular Place of Business: If you do not have a qualifying home office or regular workplace, deductible auto expenses do not start until you arrive at your first temporary work location. After you arrive at your first temporary business location, trips to other temporary work locations are deductible. But, trips from a temporary work location back to your home are considered commuting and are not deductible. There is an exception to this rule when the temporary work location is outside of the general area where you sell properties. Those trips to and from your home are deductible.

- Business Purpose: The primary reason for your trip must be the conduct of business directly related to your real estate profession. The trip must be necessary, and you must expect a business benefit to arise from it. Merely handing out a business card while getting gas or eating breakfast does not make the location a temporary workplace. Throwing a ream of copy paper into a cart full of groceries does not make the outing a deductible business trip. Making sure your temporary locations qualify for a deduction is something we discuss in detail in our Auto & Home Office Course.

- Business Conducted: The primary purpose of the business trip must not only have a business purpose, you must also conduct business at that location. For example, a Sunday drive through the countryside trying to find property for a client does not make the drive deductible. You must have a business destination in mind - specific properties to inspect. Then, you must engage those properties in a meaningful, business manner if you wish to deduct the trip.

Determining what is and is not a temporary work location is a lot more challenging than many Real Estate Agents believe and the reason the deduction is so commonly denied by the IRS. Helping you deduct legitimate business trips and audit-proof your deduction with appropriate records is the purpose of Auto & Home Office Deductions for Real Estate Agents.

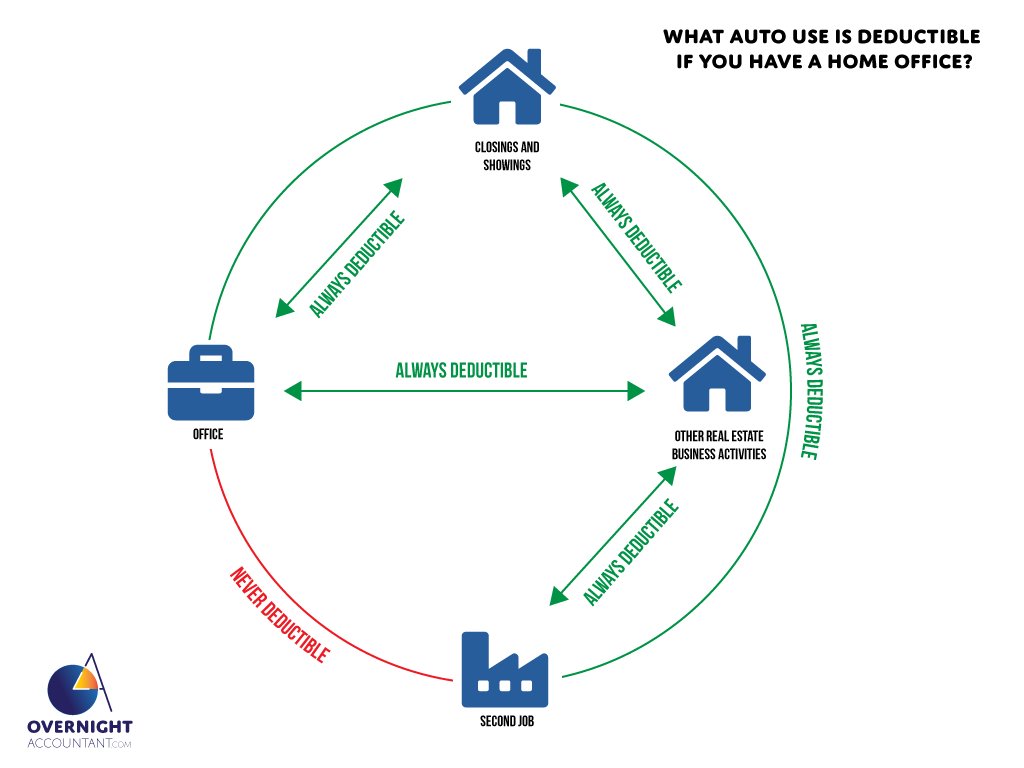

Auto Use with Qualified Home Office: Having a qualified home office simplifies the determination of deductible auto use. Your primary work location is your home. All business-related travel to and from primary work location is a deductible. As long as the primary purpose of a trip is business-related, it’s deductible!

The image below shows what auto use is deductible if you have a home office.

Other Auto Issues: Knowing which trips are deductible is just start of deducting auto use on your tax return. If you have a qualifying home office, you must make sure it stands up to IRS scrutiny. You must also determine the method you will use to claim your auto deduction, the Standard Mileage Rate or the Actual Cost Method. Finally, you must retain records that will substantiate your home office and auto deduction to the IRS.

Keep Learning: We hope this article has helped you better understand the relationship between the qualified home office and deductible auto use. If you’re interested in maximizing and audit-proofing your home office and auto deduction, we invite you to take our course, Auto & Home Office Deductions for Real Estate Agents. If you really want to minimize the tax you pay, our Comprehensive Tax Cuts for Real Estate Agents Library is for you. This searchable video library is the preeminent authority for real estate agents who are serious about cutting their tax due. It covers everything a real estate agent needs to know to maximize and substantiate every possible deduction real estate agents can take on their business tax return.

All courses and articles are for informational purposes only and do not constitute tax advice. Taxes are complicated - do not act on course information without consulting a professional. Always refer to treasury regulation before making any tax decision. Read the full disclaimer.

Overnight

Overnight